March 17: Crypto Summary

$APE coin launched and drops hard at listing. Is this a bad sign for BAYC?

gm to everyone sipping on some hot brew.

Happy St. Patrick’s day ☘️ Bitcoin, time for you to give us some green!

Markets

Here are today’s market moves:

Here's what you need to know:

BAYC $APE coin gets listed on exchanges

Yesterday, we spoke about the roadmap of BAYC after it acquiring CryptoPunk.

Today, about 4 hours ago, the $APE coin was launched.

Upon listing on exchanges, it falls from $40 straight to $8.

A massive sell off is usually expected after listing but this must hurt for anyone who bought at $40.

This was expected and is like a really well known fact.

Time for some $APE coin TOKENOMICS.

All images are from apecoin.com

When an NFT community is launching its token, the holders of the NFT are rewarded with an airdrop. This is like a token of appreciation for holding the NFT through thick and thin.

In the case of $APE, the total supply = 1 Billion tokens

62% of that was allocated to NFT holders and other resources.

150M tokens were allocated to BAYC/MAYC holders as shown in the above image. Each holder got approx 10k $APE coins. This was basically FREE money.

So when the token listed, they sold. This is pure paper hand behaviour. NGMI. Could also be an indication that the holders were not seeing a future in the coin and cashed out ASAP. Hence the price drop from $40 to $8.

16% of the supply was kept aside for the company that owns BAYC. Yuga Labs. They could use these funds to fund further initiatives for the project. Tokens would be released after 12 months in a slow and careful manner so that the price of $APE isn’t affected drastically. After the lockup period is done, every month ~277k tokens would be unlocked. This would go on for 36 months.

As you can see in the image, Yuga Labs has made it a point to donate a part of the 16% allocation to a charity called Jane Goodall Legacy Foundation. The coins kept aside for charity are also in a lock-up period of 12 months.

14% of the supply was kept aside for people who helped make this possible. This could vary from developers and designers to marketers and volunteers or anyone who lent a helping hand in the journey,

These were 140 Million coins with a lock-up period of 12 months.

Now, the main part.

I’m glad that they allocated a low percentage to founders as some project founders are known to dump their coins on the community. The lock-up of 12 months period helps prevent such behaviour.

After the lock-up period, approx. 2M coins would be unlocked every month for 36 months.

That brings us to the end of the tokenomics for the $APE coin.

I still feel there could be some money made in the coin but I’ll be waiting for a week or two before buying. Need to check out the behaviour of the community.

This is not financial advice for you’ll. DYOR.

Here is some hopium if you need it

We are in this era of NFTs👇

Check this out

Worried about forgetting your seed phrase? Or worried about a nuclear apolcalypse that’s coming and loosing your funds?

Not anymore! Get it your seed phrase imprinted on steel by this company 🤯

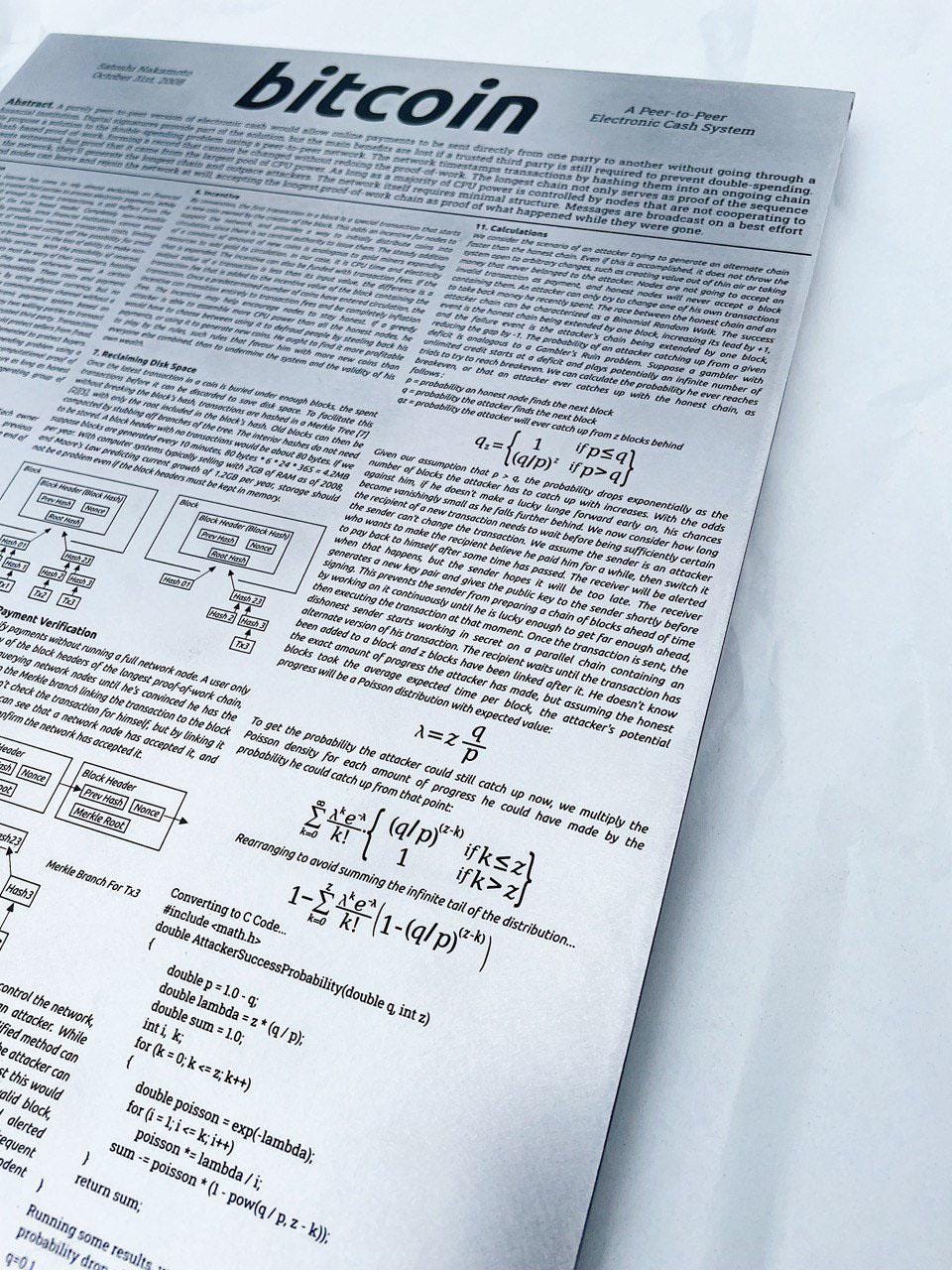

Oh, they also make .030" thick stainless steel Bitcoin whitepaper!

Check it out

Did you hear?

Mark Zukerberg is bringing NFTs to instagram!

Crypto lingo of the day

Green Dildos:

"Ahh I love to wake up in the field of green dildos" is not what your parents want to hear. You should quickly explain that it means that the market went green as the dildos represent the green candlestick graph.

Did you like this edition? Let me know!

Your comments help me improve. Click on a link below to share anonymous feedback!